A Summary History of The Santon Group

The Santon Group has also been instrumental in award-winning residential developments, particularly the conversion of listed buildings not currently in residential use, for almost 20 years.

The Santon Group has also been instrumental in award-winning residential developments, particularly the conversion of listed buildings not currently in residential use, for almost 20 years.

Santon moves into its newly purchased headquarters building in Ealing, West London. Other tenants include HSBC Corporate Banking, Insight Software.com and William Sturges Solicitors

A successful year for The Highland Club as the Abbey Church conversion and extension is completed and the development wins it's 9th award!

Santon backed by South African private equity fund, MAS, purchases a 14.5 acre site on the banks of the River Ouse in Lewes, East Sussex, from NAMA (Ireland’s National Asset Management Agency). The industrial estate presents an ideal opportunity to rejuvenate the area with retail, hospitality, commercial and residential components.

The Santon Group successfully helps refinance Anglo Irish debt of £6m on its Highland Club Development.

The Santon Group disposes of £347 million of its completed development stock.

The Santon Group completes Tesco's second zero-carbon store (46,000 sq. ft.) (Tesco in Bourne, Lincolnshire)

The Santon Group and the Sandhu Charitable Foundation subscribe for £2.2m of Loan Stock in Oriel Securities Ltd.

The Santon Group disposes of £389 million of its completed development stock.

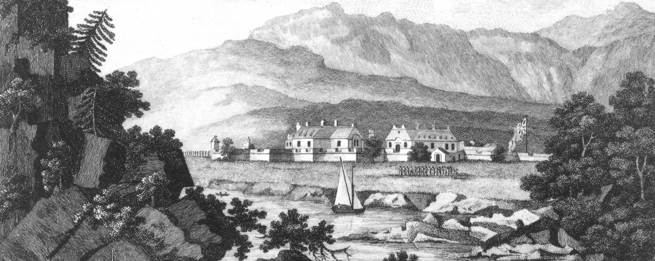

The Santon Group starts the last phase of the Highland Club Development on Loch Ness.

Santon Capital and Santon Development groups merged.

Bim Sandhu becomes a Non-Executive director of Oriel Securities Limited and together with the Santon Pension Fund invests in Oriel to become one of its largest shareholders.

Santon's Portal West Distribution Park opens and is short-listed for Industrial Development of the Year at Insiders' 2010 South West Property Awards.

Santon purchases a significant stake in The Conygar Investment Company Ltd.

The Santon Group disposes of £110 million of its completed development stock.

Santon sells 3 investment properties on a 6.3% yield and fully repays associated bank debt.

Raven Mount plc sold to Raven Russia Ltd and Bim Sandhu leaves to become full time CEO of The Santon Group and sole shareholder.

£575m facility signed with RBS to undertake developments; £11m drawn down - balance of facility cancelled due to Credit Crisis in early 2009.

HSBC facility to Santon Group Developments Limited increased to £600m.

The group remaining in private hands is renamed The Santon Group.

Raven Property Holdings plc sold to Raven Mount plc for £40m in shares. Bim Sandhu becomes CEO of Raven Mount plc.

Santon Group Developments Limited obtains a £100m development facility from HSBC to undertake retail commercial development.

Santon Group Developments formed by Bim Sandhu, Vince Donnelly and Sean Carey to develop commercial property assets.

Our Highland Club Development on Loch Ness was Highly Commended in the Property Advertising Marketing and Design Awards

Our St Andrew's Hospital listed development in Norwich wins the Broadland Award 2003 in recognition of the contribution made to the enhancement of the environment.

Our St Saviour's House residential conversion of a Church wins the Best UK Property award at the Mercedes-Benz International Property Awards 2002.

Capital Tower sold for £17.4 million.

Raven Property Holdings plc created as the main vehicle for residential and development assets.

Hagley Road sold for £19.8 million, following refurbishment, lease re-gearing and lettings.

The Group purchases a portfolio of pubs from Noble House.

The Group purchases 24 storey 130,000 sq ft Capital Tower, Cardiff for £14.6 million.

The Group purchases 135,000 sq. ft. No 1 Hagley Road, Fiveways, Birmingham for £8.25m in joint venture with Dresdner Bank & their clients.

Our LaFone Street development Commended in the Best Apartment Building category at the National Housebuilder Design Awards in partnership with the Guardian.

Principal adviser on the acquisition of the £84m Pillar Portfolio for The Atlas Partnership, its management and subsequent disposal for in excess of £100m.

Our Tehidy Park, Cornwall development wins the prestigious Gold Award for the Best Renovation in the What House?/Sunday Times awards.

Our Tehidy Park, Cornwall 52 unit residential conversion of the Grade 2 listed building, was Highly Commended The UK Property Marketing & Design Awards.

The external investors are brought out and the vehicle becomes the principal property vehicle for the property interests of Bim Sandhu and Bilton brothers

The Group completes its first major commercial development; the Homebase store in Staines.

Bim Sandhu and current Financial Director Sean Carey join the group. Net assets are less than £1m.

Founded as The Raven Group, a small tax efficient vehicle for investors to take advantage of the Close Company rules. £1m raised through 2 fundraisings.